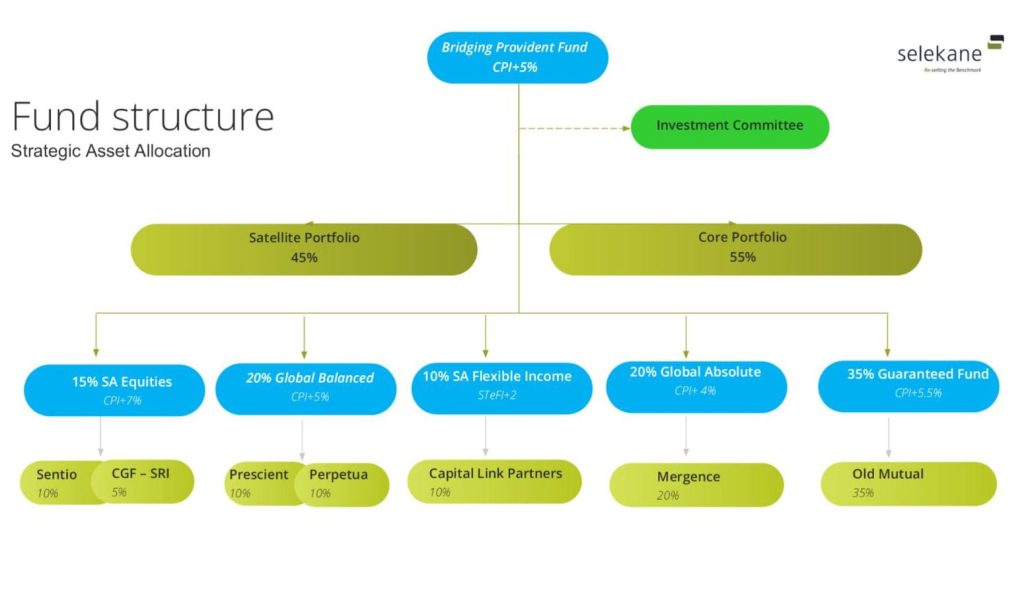

investment strategies

Investment Objectives & Policy

At Bridging Provident Fund, our investment mission goes beyond the ordinary. We are dedicated to exceeding financial expectations, aiming to generate robust returns that outpace inflation by 5% annually over 3-5 years.

Strategic Investment Approach

Conservative Risk Approach for Positive Real Returns

Our strategic investment approach is grounded in a conservative risk philosophy. We strive for positive real returns while actively mitigating downside risks, ensuring a secure foundation for our members’ retirement benefits.

Diversified Portfolios for Stability, Growth, and Protection

Explore the portfolios where your investments thrive:

1. Old Mutual Absolute Return: A commitment to capital stability.

2. Mergence Absolute Return: Dedicated to capital protection.

3. Sentio Capital: Strategically targeting long-term growth.

4. Unani Domestic Equity: Aiming for long-term growth on the domestic front.

5. Schroders International: Focused on growth in international markets.

Overview of Strategic Investments

Choose Bridging Provident Fund for a future where your investments flourish. Our commitment to your financial well-being is reflected in our smart investment mix, ensuring stability, growth, and protection.

Smart Investment Mix

Experience the power of smart investments with Bridging Provident Fund. Our strategic mix is carefully crafted to prioritize your financial well-being:

Stability: Investments dedicated to capital stability.

Growth: Portfolios strategically targeting long-term growth.

Protection: A commitment to capital protection and positive real returns.